While the requirements for serialization in the pharmaceutical supply chain are generally regarded as inevitable counterfeiting is simply too large of a problem to not be addressed there is some uncertainty around the specifics,particularly globally.

Regulations are advancing at various speeds around the world and, to date, global standards as to how serial numbers should be formatted have not emerged.

This uncertainty has required that pharmaceutical manufacturers move forward cautiously in their approach to serialization. They must take steps to prepare without locking themselves into technologies that may not support future requirements. To that end, many have put in place the systems required to apply and capture serialization data in their packaging processes, but, have, in general, not addressed the impact of tracking these numbers across the supply chain.

This is partly due to the nature of the typical pharmaceutical supply chain, which is more dependent on third-party logistics providers (3PLs) for downstream processes than other industries. These providers enable pharma companies to minimize supply chain assets and focus their capital on research and development, but they tend to limit their own investments in automation because short-term contracts don’t enable them to realize a return on their investment within the contract period.

The other consideration is the different priorities that have existed in the pharma industry compared to other industries.Where retailers and e-commerce companies, in particular, have adopted warehouse automation to achieve the speed and efficiency they need to be competitive, the focus in pharma has been on risk mitigation. Pharma companies have historically been willing to accept some inefficiency if it means less risk.

Based on those factors, it’s tempting to conclude that this is not a good time for pharma companies to invest in supply chain technology. In fact, the opposite is happening.Serialization requirements are continuing to advance and the process of managing serial numbers requires significant changes to the IT systems and processes that support the supply chain. Pharma companies are also now increasing their focus on supply chain efficiency. Forward-thinking manufacturers are taking steps to address these challenges today by evaluating the processes, software and machinery in the supply chain in light of serialization requirements. They are finding they can make investments that move them closer to meeting future serialization requirements, have value beyond serialization and are flexible enough to adapt to requirements as they evolve.

SUPPLY CHAIN IT REQUIREMENTS

One area of focus is the IT systems that support the supply chain. Serialization data must be maintained and reconciled across the product, case and pallet in the warehouse and will ultimately be required to be tracked across the supply chain.That adds significantly to the data being captured and stored; yet, few manufacturers currently have the ability to use that data to achieve product visibility across the supply chain.One problem many face is the fragmented nature of supply chain IT. IT systems have generally been deployed on an as needed basis, creating a distributed IT support system that isn’t well suited to the future demands of serialization. The process of centralizing these systems will be time consuming in some cases and it isn’t too early to start down that path.

This is an effort that makes sense for manufacturers because,in addition to simplifying the management of serialization data, it creates opportunities for them to advance Industry 4.0 initiatives by using big data analytics to reduce risk, improve supply chain performance and gain insights into market requirements and demands.

WAREHOUSE MANAGEMENT SOFTWARE REQUIREMENTS

Another area of focus is warehouse management software (WMS). Most WMS systems in use today have the basic capabilities to support serialization, but may not be well suited to support the supply chain of the future. Introducing state-of-the-art warehouse management software today can help facilitate the evolution to serialization while adding support for supply chain technologies that minimize risk and enable new capabilities. This is an effort that makes sense for manufacturers because,in addition to simplifying the management of serialization data, it creates opportunities for them to advance Industry 4.0 initiatives by using big data analytics to reduce risk, improve supply chain performance and gain insights into market

This is an effort that makes sense for manufacturers because,in addition to simplifying the management of serialization data, it creates opportunities for them to advance Industry 4.0 initiatives by using big data analytics to reduce risk, improve supply chain performance and gain insights into market

requirements and demands.

Serialization data must be maintained and reconciled across the product, case and pallet in the warehouse and will ultimately be required to be tracked

across the supply chain.The WMS must be able to support aggregation of salable product serial numbers across cartons and palettes so every unit can be tracked to a specific carton and pallet. That’s generally not too complicated until you start moving cartons between pallets or products between cartons. In this case,the operator must have the ability to easily update the serial numbers on both the pallet or carton from which product was moved and the pallet or carton to which it was moved.

WAREHOUSE MANAGEMENT SOFTWARE REQUIREMENTS

Beyond serialization, there are other capabilities that are important to ensure the WMS can support the warehouse as serialization and other warehouse technologies continue to evolve, including ease-of-integration, virtualization and support for automation.

Integration with MES and ERP systems is already essential to managing materials in pharma manufacturing. But, this has traditionally required expensive and time-consuming custom programming. Newer generation warehouse management systems are moving away from proprietary protocols and embracing common standards that greatly simplify software integration. This will become more important as systems across the supply chain are integrated to enable product tracking from manufacturing to dispensing.

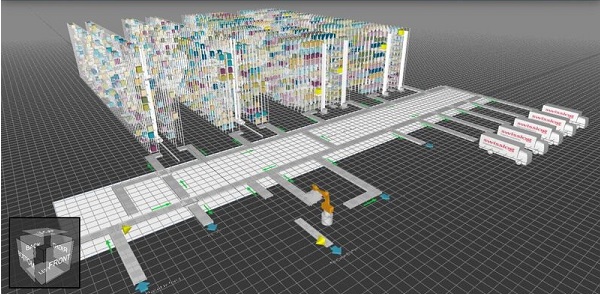

Virtualization is emerging as a key technology that creates a host of new opportunities to improve how warehouses are operated and maintained. Within the WMS, sensor data from processes and equipment is merged with virtual warehouse models and simulations to create a digital copy or shadow of the warehouse. Already, virtualization is enabling functions such as real-time condition monitoring and material flow monitoring and much more is possible. Solutions where this data is used to see into the future by combining real-time data with simulated changes to material flows are not too far away.

WAREHOUSE MANAGEMENT SOFTWARE REQUIREMENTS

Virtualization is emerging as a key technology that creates a host of new opportunities to improve how warehouses are operated and maintained.As it evolves, virtualization will become a valuable tool in the design and implementation of warehouse processes and changes, allowing pharma companies to evaluate the impact of new equipment, processes changes or new products virtually to optimize processes and material flows in the design phase. Virtual reality technology is advancing rapidly and it won’t be long before supply chain and warehouse managers are donning virtual reality glasses to “walk through” and explore warehouse changes virtually in the design phase.A final consideration for the WMS is its support for automation.

USING AUTOMATION TO MITIGATE RISK

Many pharma manufacturers already rely on automated storage and retrieval systems to provide materials to manufacturing. These systems increase the accuracy of intralogistics processes; however, compared to the systems available today, they are expensive, lack flexibility and could be difficult to implement. This limited their application for large companies with stable processes. New modular automation systems and collaborative robotics work with automated guided vehicles (AGVs) to make automation more flexible, cost-effective and easier to implement.Downstream from manufacturing, new requirements, including serialization, SKU growth, and the need to support smaller batches, has increased the logistics effort in general,which makes automation of these processes more attractive.  Companies that were previously limited in their ability to use automation can now tap into new less expensive and easier-to-deploy solutions to address these challenges. These include:

Companies that were previously limited in their ability to use automation can now tap into new less expensive and easier-to-deploy solutions to address these challenges. These include:

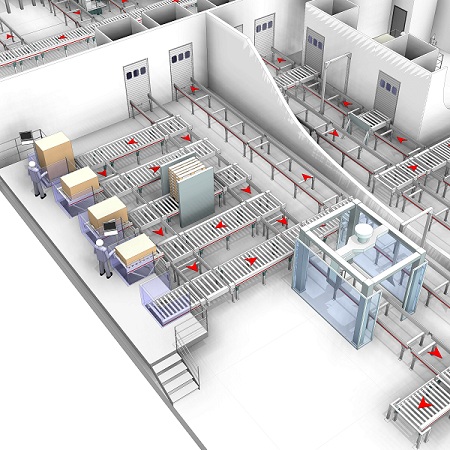

- Production order picking systems that allow operators to easily and accurately collect the products and quantities required for the next production order on a pallet that is then delivered to the production line. These systems bring product to the picker to eliminate walking distance and ensure controlled picking processes through scanning, line clearing and pick-to-light technology.

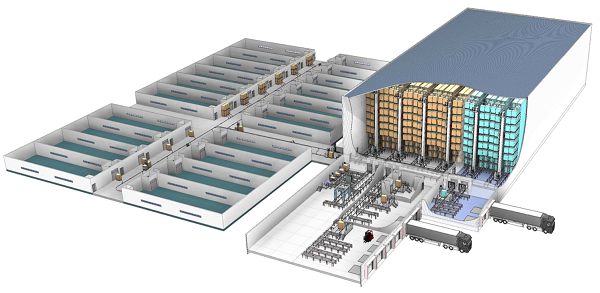

- Pallet systems that provide automated storage of raw materials, semi-finished goods and finished goods, which can include goods-to-person stations that support order preparation, production and shipping. These systems can be used to store semi-finished goods in the warehouse to enable just-in-time delivery to production.

They can also support different temperature zones for manufacturers who must maintain tight temperature control over some products. They use automated cranes to move pallets within storage and AGVs to transport pallets from production and packaging lines.Automated pallet handling systems, such as the Vectura stacker crane from Swisslog, can be used to maximize space efficiency in the storage of raw materials, semi-finished goods and finished goods.

Shuttle systems and miniload cranes that provide dynamic storage and retrieval of light goods. Shuttle systems can consolidate and release totes with product at high rates in sequence. Mini load cranes transport light goods like totes and trays fast and reliably for production storage. The crane moves up and down a single aisle to store and retrieve products in a single-deep or double deep configuration. Although these technologies have been around for awhile, new modular designs, smart software and increased performance now make them even more attractive for pharma companies.

Shuttle systems and miniload cranes that provide dynamic storage and retrieval of light goods. Shuttle systems can consolidate and release totes with product at high rates in sequence. Mini load cranes transport light goods like totes and trays fast and reliably for production storage. The crane moves up and down a single aisle to store and retrieve products in a single-deep or double deep configuration. Although these technologies have been around for awhile, new modular designs, smart software and increased performance now make them even more attractive for pharma companies.

While older WMS systems are not designed to support automation, requiring an additional software layer between the WMS and the automation system, new modular,automation-centric WMS platforms eliminate this extra layer and greatly simplify the transition to automation.By automating product movement in packaging, pharma manufacturers can minimize the risk of human error, increase efficiency and improve the management of product recalls. A newer, automation-centric WMS can enable this transition while also providing easier integration with other software systems, support for virtualization and the ability to leverage self-learning capabilities for process optimization in the future.

Goods-to-person automation efficiently supports production by streamlining the process of collecting and palletizing materials required to support production orders.

While the long-term goal of serialization is track-and-trace capabilities across the supply chain, the initial requirements widely focus on the first and last leg of the supply chain:the manufacturing packaging process and the retailers and pharmacies dispensing pharmaceuticals to customers. In the near-term, pharmaceutical distributors are exempt from capturing and communicating serialization data.The impact of serialization at the end of supply chain is similar to that at the beginning. Hospitals and pharmacies are preparing for serialization but uncertain as to when compliance will be required. Hospitals, in particular,have implemented GS1-compliant automated inventory management systems that provide track-and-trace capabilities. This is particularly valuable in larger hospitals that may have products distributed around the facility—and may be required to locate a specific batch of a product subject to recall.

Similar to the manufacturer’s packaging operation, these pharmacies are turning to automated storage and retrieval systems to minimize the risk of human error. Automated storage systems not only eliminate picking errors and increase safety at the dispensing stage, but also create a more efficient

pharmacy workflow.

AN INDUSTRY IN TRANSITION

The challenge of serialization is a massive undertaking for the pharma industry, which is still clouded by uncertainty. Yet, pharma manufacturers have made significant progress in establishing the foundation for compliance. They have the technology and processes in place to track materials as they move through manufacturing to become semi-finished goods and then finished goods and many are now using the impetus of coming regulations to replace outdated WMS software and increase their use of automation to mitigate risk and bring new levels of intelligence and sophistication to the pharmaceutical supply chain.