Johnson & Johnson will be paying $3.05 billion so as to acquire Halda Therapeutics, thereby getting a novel cell death platform while at the same time also strengthening its prostate cancer franchise that’s built on Erleada.

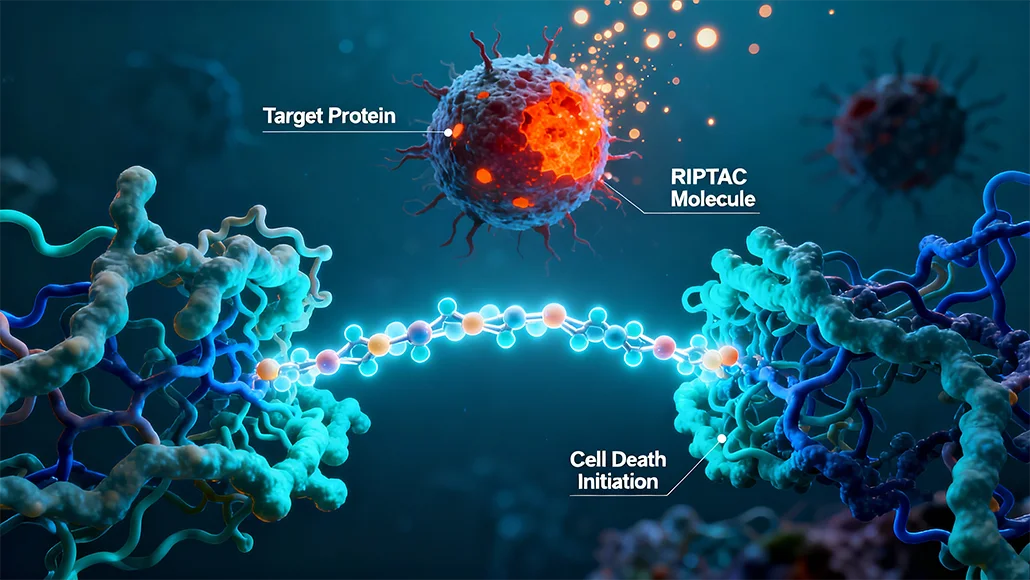

At the mainstay of the acquisition is the regulated induced proximity targeting chimera – RIPTAC platform from Halda, which offers rise to bifunctional small molecules that go on to simultaneously bind tumor-specific protein as well as a protein having essential function to cell survival in endeavors to induce the cancer cell death.

This new hold and kill mechanism could as well go ahead and address the ability of cancer to come up with resistance through evolving the bypass mechanisms, as per Halda.

The November 17 announcement comes shortly after Halda reported early phase 1 data for the lead candidate of the cell death platform, HLD-0915, which, by the way, happens to be the crown jewel of the proposed $3.05 billion cash deal by J&J.

It is well to be noted that HLD-0915 happens to target the androgen receptor as well as bromodomain 4 – BRD4. In a phase 1/2 trial that’s currently ongoing, Halda enrolled 31 patients having metastatic castration-resistant prostate cancer – mCRPC who had already progressed on prior therapies, which included a minimum of one androgen receptor pathway inhibitor like Erleada from J&J. The patients may as well have received almost two prior taxane chemotherapies and, at the same time, may have also had the prior exposure when it comes to radioligand therapy Pluvicto by Novartis.

Among the 22 patients who had completed a minimum of two cycles of the once-daily oral drug at numerous doses, 59% went on to achieve a greater than 50% decrease within the prostate-specific antigen, and 32% of the patients went on to demonstrate a higher than 90% deduction, as per the results that were released at the AACR-NCI-EORTC triple meeting in October 2025.

Interestingly, Halda went on to describe the treatment-related adverse events – TRAEs as being infrequent as well as generally low grade. One patient who went on to receive the drug at the highest dose, which was a 100-mg dose, happened to experience dose-limiting toxicity pertaining to liver enzymes as well as bilirubin elevations. All the grade 3 or higher TRAEs throughout the doses were reversible, and there were no treatment-related deaths that were reported, said Boston biotech.

Based on the outcomes, Halda has gone on to select the two middle doses tested – 25 mg and 50 mg when it comes to dose expansion testing in order to determine the dose pertaining to registered studies.

The R&D head of innovative medicine, John Reed, M.D., Ph.D., from J&J, went on to say in a Nov. 17 press release that the HLD-0915 demonstrated quite an impressive preliminary efficacy along with a robust early safety profile from phase 1/2 results. The company looks forward to accelerating the current study, he confirmed.

Given the present unmet need, this once-daily therapy happens to have the potential to go ahead and transform the patient outcomes due to its novel precision cancer cell-killing approach, which can go ahead and overcome mechanisms that resist the treatment, remarked the press release from J&J.

It is worth noting that the proposed acquisition is going to further bloat the pipeline of J&J when it comes to prostate cancer, on which the pharma company has gone ahead and placed many bets that are beyond the FDA-approved Erleada as well as Akeega.

Apparently, J&J recently advanced pasritamig, which is a T-cell engager that targets kallikrein 2 -KLK2, into phase testing like a monotherapy in late-line mCRPC. Yet another phase 3 is on the cards that is going to pair bispecific with docetaxel. In the past, the anti-KLK2 radioligand therapy candidate of the company, JNJ-6420, was linked to 4 deaths, and that too in an early-stage trial.

Notably, in a phase 1 trial that was conducted in pretreated mCRPC patients, pasritamig, which was at the recommended phase 2 dose, attained a 42.4% PSMA50 response rate.

As part of the $2 billion acquisition of Ambrx Biopharma in 2025, J&J also went on to obtain an antibody-drug conjugate targeting PSMA, which happens to be the same target as Pluvicto.

Apart from HLD-0915, the RIPTAC-based pipeline from Halda also happens to include many earlier-stage candidates related to breast, lung as well ans other tumor types. The cell death platform may as well help to create certain targeted therapies that go beyond oncology, noted J&J.

According to J&J’s chair of innovative medicines, Jennifer Taubert, in a November 17 statement, said that this acquisition is going to further strengthen their deep oncology pipeline with quite an incredible lead asset in prostate cancer as well as a platform that happens to be capable of treating numerous cancers as well as diseases that go beyond oncology, hence offering a potential mid- as well as long-term catalyst as far as growth is concerned. She added that they look forward to combining the pipeline of Halda, its platform as well as people with their own world-class R&D and commercial and manufacturing capabilities and hence advancing their goal of getting these therapies to patients all across the world.

In another release, Halda went on to say that the transaction is anticipated to close in the following months.

It is worth noting that all-out acquisitions versus licensing happen to be on the rise across Big Pharma lately. Apparently, Pfizer just beat Novo Nordisk in order to acquire Metsera, the obesity biotech, for almost $10 billion, with a once-monthly injectable GLP-1 candidate being the centerpiece of the deal. Merck & Co. is looking to shell out $9.2 billion so as to take over Cidara Therapeutics, in addition to the non-vaccine influenza prevention med, which was in the past ditched by J&J.