MIMETAS, leader in organ-on-a-chip products and tissue models, has secured 20.5 million USD in financing from an international syndicate from Asia and Europe.

MIMETAS will use the proceeds of this Series B financing round to expand its global commercial footprint with the OrganoPlate® organ-on-a-chip platform. In addition, the company will broaden its product portfolio, establish tissue production facilities, develop novel OrganoPlate® products and expand into clinical market segments, including personalized medicine. The company has operations in the Netherlands, USA and Japan.

Investors are European Life Sciences Growth Fund (ELSGF, Singapore), Aglaia Oncology Fund II (the Netherlands), Korys (Belgium), Cathay Venture (Taiwan), InnovationQuarter and Oost NL (the Netherlands).

Ginger Hsiao, fund manager of ELSGF, acting as spokeswoman for the syndicate: “From the start, we were impressed by MIMETAS’s technology and highly talented team. We consider the company as today’s leader in the organ-on-a-chip space with tremendous growth potential in the coming years. Its customer base already includes leading multinationals from Europe, US and Asia and the adoption of the platform ranges from academic users to high-throughput screening facilities for pharmaceuticals. We are looking forward to supporting the MIMETAS team with their commercial expansion and addressing new markets.”

“This strong investor base ticks all the boxes for MIMETAS in this phase of corporate development.”, according to founders Jos Joore and Paul Vulto, “Korys has solid expertise in product commercialization at the interface of hardware and biology, while Aglaia brings a wealth of clinical and oncology expertise to the company. ELSGF and Cathay will support the company in expanding in the Asian market. This is complemented with local support from Oost NL and InnovationQuarter.”

About MIMETAS

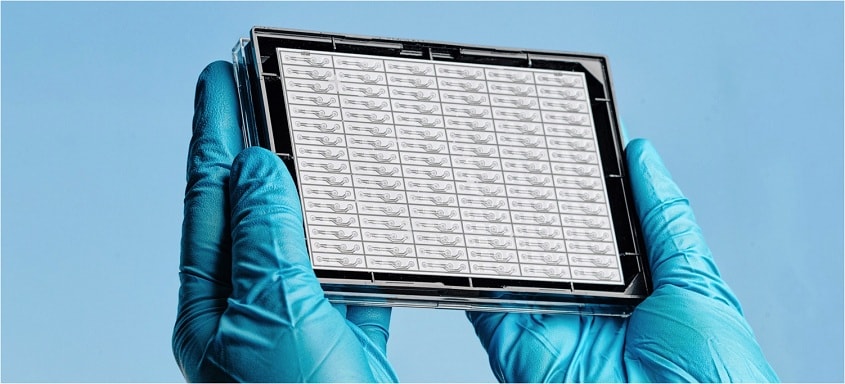

MIMETAS (Leiden, the Netherlands, Gaithersburg, USA) provides organ-on-a-chip products for compound testing, screening and fundamental research. Its flagship product, the OrganoPlate®, supports 3D cell culture under continuous perfusion, with membrane-free co-culture and epithelial and endothelial tubules. The company develops and validates customized disease, toxicology and transport models and ultimately will make its technology available for personalized therapy selection. MIMETAS has developed models for the kidney, liver, gut, brain and a range of oncological applications, that offer better predictivity towards human physiology as compared to laboratory animals and conventional cell culture models. Since its commercial launch in 2014, MIMETAS has grown its customer base to half of the global top-50 pharmaceutical companies, in addition to chemical, food and consumer goods companies. The fast market acceptance of the OrganoPlate® is driven by its unsurpassed ease-of-use and throughput, in combination with complex human biology and disease relevance.

About European Life Sciences Growth Fund (ELSGF)

ELSGF is a private capital fund investing in ‘Best of Europe’ Life Sciences for growth into the Asian markets. The fund creates value by building out a presence in Asia for its portfolio companies and adding revenue from the region to their existing business. The fund is managed by Pilgrim Partners Asia in Singapore.

About Aglaia

Aglaia invests in ground-breaking technologies that have the potential to translate into solutions for the prevention and treatment of cancer. Aglaia is actively involved in the companies it invests in. By translating high-potential research into commercially and clinically successful products Aglaia gives meaning to the concept of impact investing.

About Korys

Korys is a family-owned holding company investing in non-listed companies, private equity funds and managing a portfolio of listed investments. Today, it has more than EUR 4 billion of assets under management, among which a significant participation in Colruyt Group, a leading retail company in Belgium and France. Investment decisions are taken with a long-term perspective on the basis of economic, ecological and social merit. Korys aims to create sustainable value through a diversified portfolio of investments. Korys has a team of more than 20 professionals based in Belgium and Luxembourg.

About Cathay Venture

Cathay Venture is an evergreen fund, wholly-owned by Cathay Financial Holdings, based in Taipei, Taiwan. Cathay Financial Holdings is the largest financial group in Taiwan, with registered capital of USD 4 billion. Composed of insurance, securities, banking and other diversified financial institutions, Cathay Financial Holdings is a multi-faceted financial platform servicing more than 13 million customers in Asia. Cathay Venture is committed to maximizing the potential and value of its portfolio companies with its comprehensive network.

About Oost NL

Oost NL (East Netherlands Development Agency) is an agency that focuses its activities and projects on strengthening and stimulating the economy of the provinces of Gelderland and Overijssel, the Netherlands. Oost NL acts as a bridge between government, companies and knowledge institutes and supports starting and growth-phase SMEs. Oost NL does this partly with risk capital from various revolving innovation funds, and partly through our knowledge, networks and personal contacts. With this investment, Oost NL supports employment opportunities at the production site of Mimetas at the High Tech Factory in Enschede.

About InnovationQuarter

InnovationQuarter is the regional economic development agency for West Holland. InnovationQuarter finances innovative and fast-growing companies, assists international companies in establishing their businesses in West Holland, and facilitates (international) collaboration between innovative entrepreneurs, knowledge institutes and government. In this way, and in cooperation with the business community, InnovationQuarter supports the development of West Holland to become one of the most innovative regions in Europe.